tax sheltered annuity taxation

A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. Do Your Investments Align with Your Goals.

Find a Dedicated Financial Advisor Now.

. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. New Look At Your Financial Strategy. Visit The Official Edward Jones Site.

Taxes and Distributions. You will pay normal income taxes on any future qualified annuity payments. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal.

Note that annuity payments count as ordinary income which is generally speaking not a favorable. Get Your Max Refund Today. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity.

Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. So if the annuity buyer paid 10000 and the death benefit was 100000 the heir would immediately owe tax on the remaining 90000. The maximum amount of elective deferrals an employee can contribute annually to a 403 b is generally the lesser of.

The most common tax-sheltered investments. Fisher Investments warns retirees about annuities. You could opt to take any money remaining in an inherited annuity in one lump sum.

100 of includible compensation. If you have a 403bTSA contract there is a mandatory withholding of 20 for federal taxes from any withdrawal or rollover if you take receipt of. An Internal Revenue Code 403b plan also known as a taxsheltered annuity plan is a - retirement plan for certain employees of public schools employees of certain other tax-exempt.

Non-profit organizations and charities. Taxes on tax-sheltered annuity plan contributions and earnings are not levied until the plan owner withdraws money from the plan. When you receive payments from a qualified annuity those payments are fully taxable as income.

Thats because no taxes have been paid on that money. Its similar to a 401 k plan maintained by a for-profit entity. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed and therefore the contributions and interest.

Youd have to pay any taxes due on the benefits at the time you receive them. But annuities purchased with a Roth. A tax-sheltered annuity TSA is a pension plan for employees of.

What are the tax requirements. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. However annuity heirs can also elect to.

Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

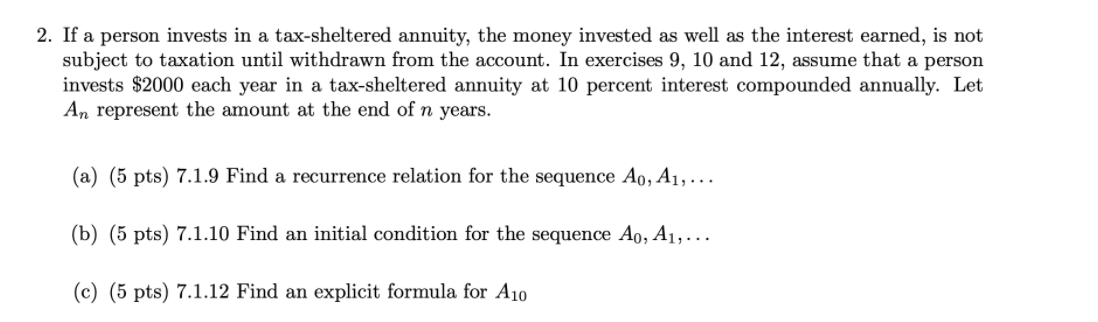

If A Person Invests In A Tax Sheltered Annuity The Money Invested As Well As The Interest Earned Is Not Subject To Taxation Until Withdrawn From Course Hero

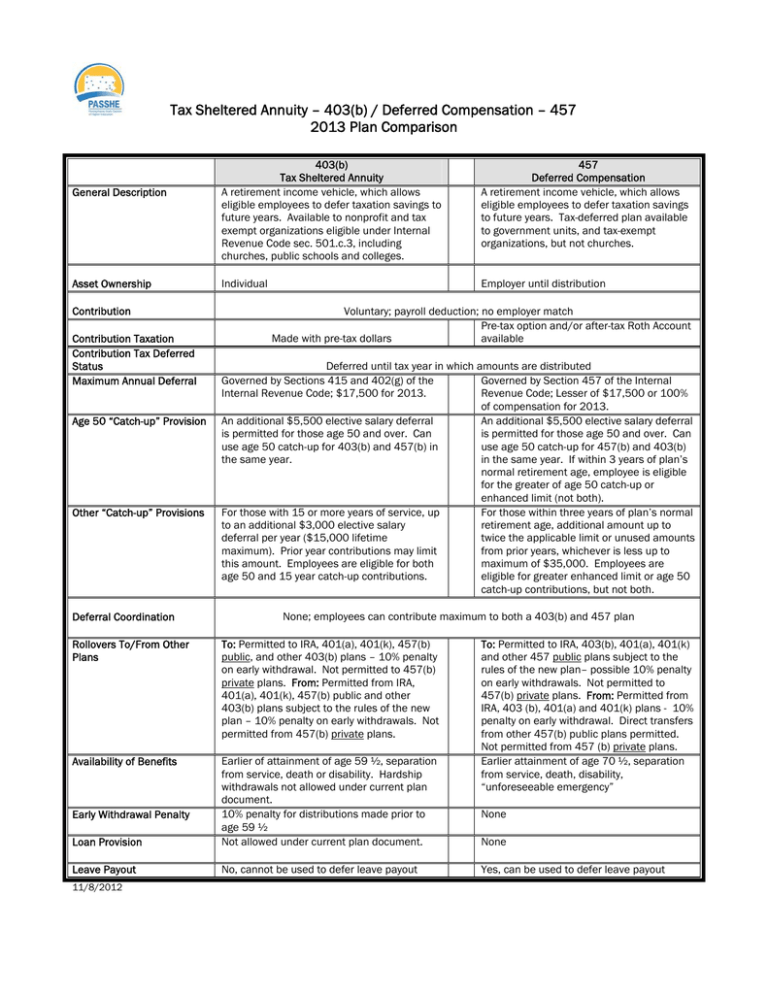

Tax Sheltered Annuity 403 B Deferred Compensation 457

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Annuity Lifetime Income Later Safety Guarantees Magi

What Is A Tax Deferred Annuity Due

Withdrawing Money From An Annuity How To Avoid Penalties

The Tax Sheltered Annuity Tsa 403 B Plan

Solved 2 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Withdrawing Money From An Annuity How To Avoid Penalties

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Taxation How Various Annuities Are Taxed

Taxation Of Annuities Ameriprise Financial

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Taxation How Are Annuities Taxed

Annuity Taxation How Various Annuities Are Taxed

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits